Payroll tax expense formula

Remember this is less than 1. Sign Up Today And Join The Team.

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Ad Fast Easy Accurate Payroll Tax Systems With ADP.

. Annual Salary on column C copy this formula on. Subtract 12900 for Married otherwise. The employee earns 1000 in a month.

Ad Explore Expense Tools Other Technology Users Swear By - Start Now. Enter General Information About Paying Your Employees. Multiply the gross pay by 06 or 0006.

Regardless of whether the employer withholds the tax or not it will remain an expense. Currently employers pay a 62 Social Security tax and a 145 Medicare tax 765 in total. Since this is the first payroll of the year the employee has only earned 48000 and is well below the 10000 threshold.

Multiply 062 times total wages to figure Social Security tax expense. Each worker pays the same 765 tax through payroll withholdings. Sign Up Today And Join The Team.

The payroll expense tax is levied upon businesses not individual. You need to match each employees FICA tax liability. Over 900000 Businesses Utilize Our Fast Easy Payroll.

2020 Federal income tax withholding calculation. Form 941 is used to report wages withholdings and calculate Social Security and Medicare taxes. Now onto calculating payroll taxes for employers.

Free Unbiased Reviews Top Picks. Ad Compare This Years Top 5 Free Payroll Software. Need formula for budgeting payroll taxes.

The payroll expense tax is a tax on employers that have Seattle annual payroll expense of 7386494 or more. For example an employee works in a company. Say on your spreadsheet Col A has Name of the employees and column B has.

Employer FICA Tax Liability Total 11475 9180 15300. Learn About Payroll Tax Systems. Multiply the number of withholding allowances the employee has claimed on his W4 form by the amount of one allowance for his filing status and the length of the pay period.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Learn About Payroll Tax Systems. The standard FUTA tax rate is 6 so your max.

As of 2021 the rate is divided between a 62 deduction for Social Security on a maximum salary of 142800 147000 for the 2022 tax year and a 145 share for Medicare. How do I do payroll in QuickBooks. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Pin On Quick Book

Payroll Journal Entries Youtube

Accounting Equation Chart Cheat Sheet In 2022 Accounting Accounting Education Payroll Accounting

Payroll Journal Entries Financial Statements Balance Sheets Video Lesson Transcript Study Com

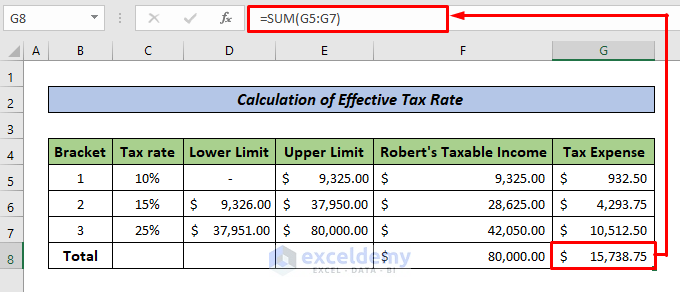

How To Calculate Federal Tax Rate In Excel With Easy Steps

Payroll Journal Entries For Wages Accountingcoach

St Ice Skousen Income Taxes Chapter 16 Intermediate

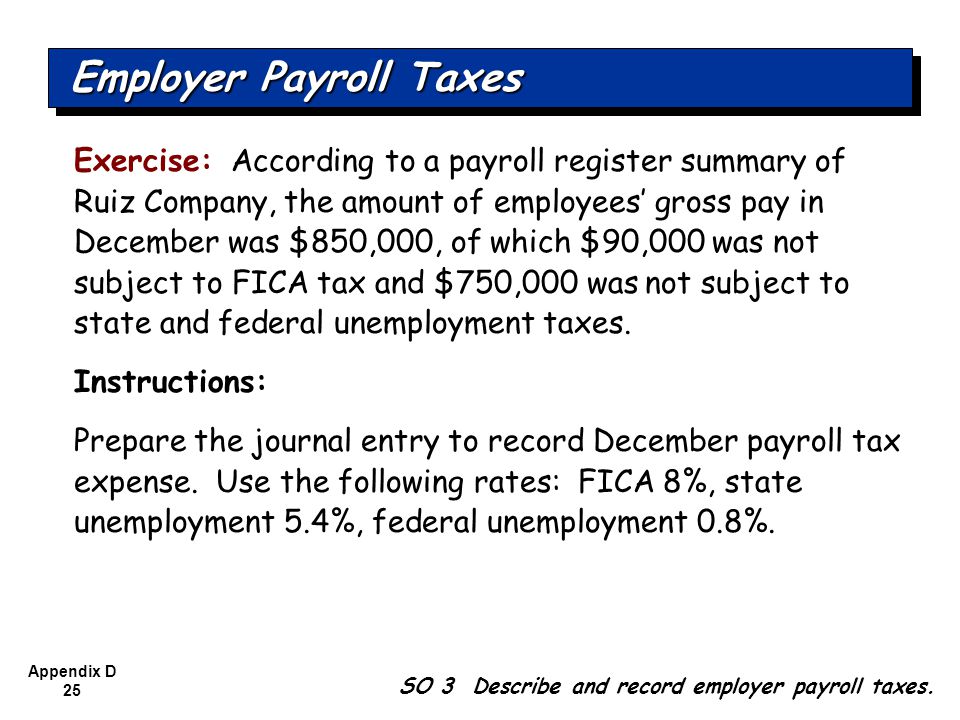

Payroll Taxes Costs And Benefits Paid By Employers Accountingcoach

Federal Income Tax Fit Payroll Tax Calculation Youtube

Calculating Income Tax Payable Youtube

Calculate Landed Cost Excel Template For Import Export Inc Freight Customs Duty And Taxes Excel Templates Excel Verb Worksheets

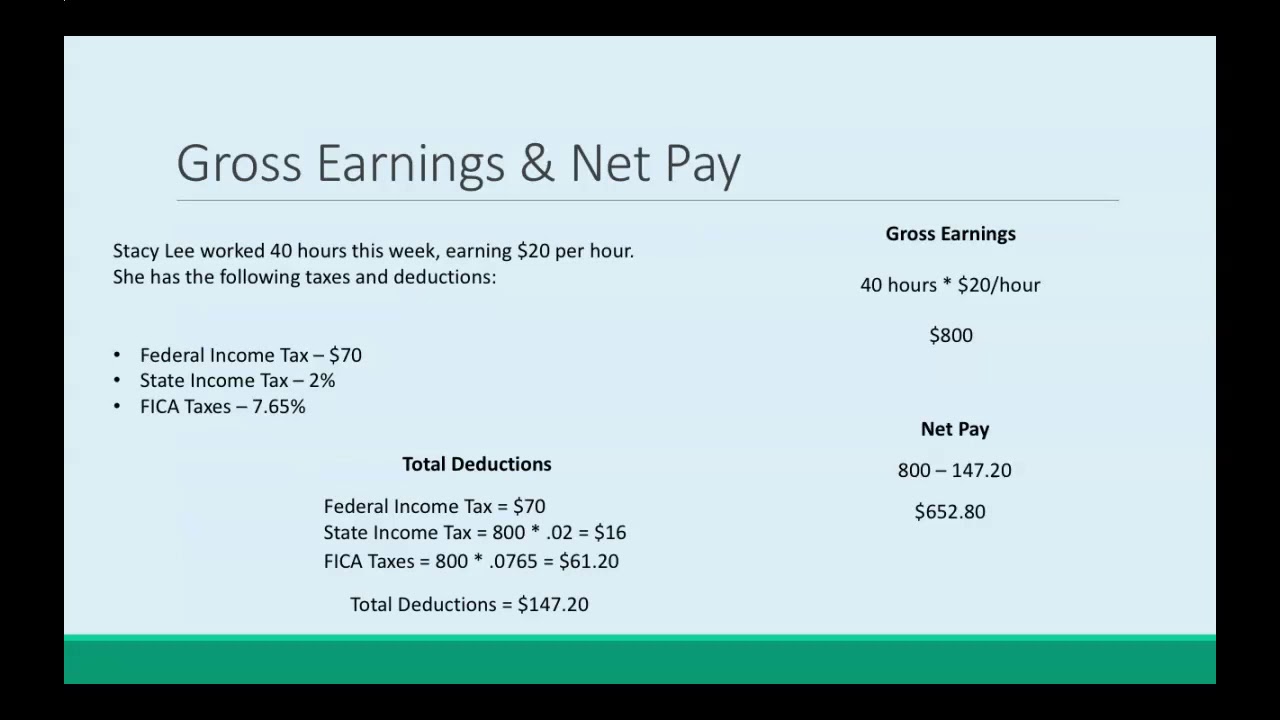

Payroll And Payroll Taxes Accounting In Focus

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Financial Accounting Sixth Edition Ppt Download

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Payroll Journal Entries For Wages Accountingcoach

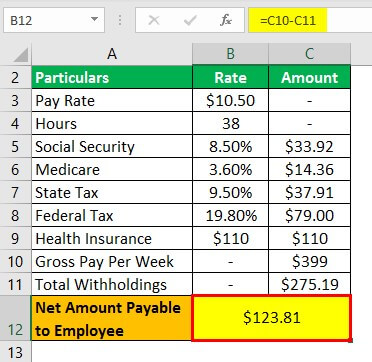

Payroll Formula Step By Step Calculation With Examples

Komentar

Posting Komentar